Tutorial: Time Series Analysis with Pandas

In this tutorial, we will learn about the powerful time series tools in the pandas library. And we'll learn to make cool charts like this!

Originally developed for financial time series such as daily stock market prices, the robust and flexible data structures in pandas can be applied to time series data in any domain, including business, science, engineering, public health, and many others. With these tools you can easily organize, transform, analyze, and visualize your data at any level of granularity — examining details during specific time periods of interest, and zooming out to explore variations on different time scales, such as monthly or annual aggregations, recurring patterns, and long-term trends.

In the broadest definition, a time series is any data set where the values are measured at different points in time. Many time series are uniformly spaced at a specific frequency, for example, hourly weather measurements, daily counts of web site visits, or monthly sales totals. Time series can also be irregularly spaced and sporadic, for example, timestamped data in a computer system's event log or a history of 911 emergency calls. Pandas time series tools apply equally well to either type of time series.

This tutorial will focus mainly on the data wrangling and visualization aspects of time series analysis. Working with a time series of energy data, we'll see how techniques such as time-based indexing, resampling, and rolling windows can help us explore variations in electricity demand and renewable energy supply over time. We'll be covering the following topics:

- The data set: Open Power Systems Data

- Time series data structures

- Time-based indexing

- Visualizing time series data

- Seasonality

- Frequencies

- Resampling

- Rolling windows

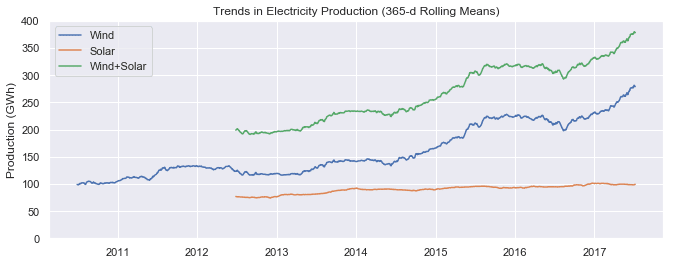

- Trends

We'll be using Python 3.6, pandas, matplotlib, and seaborn. To get the most out of this tutorial, you'll want to be familiar with the basics of pandas and matplotlib.

Not quite there yet? Build your foundational Python skills with our Python for Data Science: Fundamentals and Intermediate courses.

The data set: Open Power Systems Data

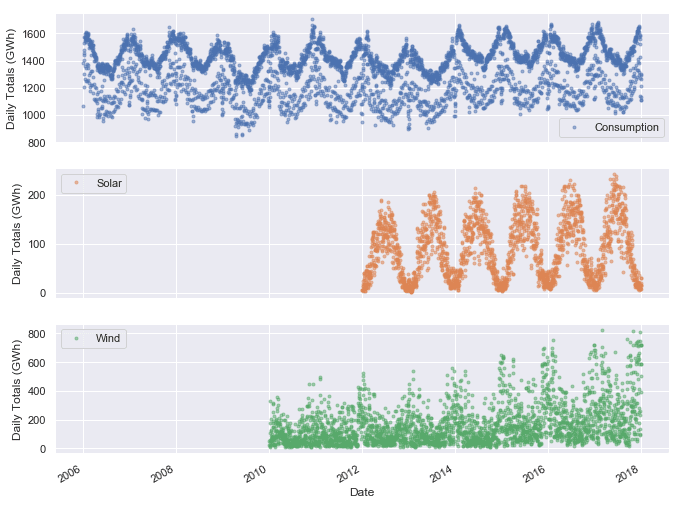

In this tutorial, we'll be working with daily time series of Open Power System Data (OPSD) for Germany, which has been rapidly expanding its renewable energy production in recent years. The data set includes country-wide totals of electricity consumption, wind power production, and solar power production for 2006-2017. You can download the data here.

Electricity production and consumption are reported as daily totals in gigawatt-hours (GWh). The columns of the data file are:

Date— The date (yyyy-mm-dd format)Consumption— Electricity consumption in GWhWind— Wind power production in GWhSolar— Solar power production in GWhWind+Solar— Sum of wind and solar power production in GWh

We will explore how electricity consumption and production in Germany have varied over time, using pandas time series tools to answer questions such as:

- When is electricity consumption typically highest and lowest?

- How do wind and solar power production vary with seasons of the year?

- What are the long-term trends in electricity consumption, solar power, and wind power?

- How do wind and solar power production compare with electricity consumption, and how has this ratio changed over time?

Time series data structures

Before we dive into the OPSD data, let's briefly introduce the main pandas data structures for working with dates and times. In pandas, a single point in time is represented as a Timestamp. We can use the to_datetime() function to create Timestamps from strings in a wide variety of date/time formats. Let's import pandas and convert a few dates and times to Timestamps.

import pandas as pd

pd.to_datetime('2018-01-15 3:45pm')

Timestamp('2018-01-15 15:45:00')

pd.to_datetime('7/8/1952')

Timestamp('1952-07-08 00:00:00')

As we can see, to_datetime() automatically infers a date/time format based on the input. In the example above, the ambiguous date '7/8/1952' is assumed to be month/day/year and is interpreted as July 8, 1952. Alternatively, we can use the dayfirst parameter to tell pandas to interpret the date as August 7, 1952.

pd.to_datetime('7/8/1952, dayfirst=True)

Timestamp('1952-08-07 00:00:00')If we supply a list or array of strings as input to to_datetime(), it returns a sequence of date/time values in a DatetimeIndex object, which is the core data structure that powers much of pandas time series functionality.

pd.to_datetime(['2018-01-05', '7/8/1952', 'Oct 10, 1995'])

DatetimeIndex(['2018-01-05', '1952-07-08', '1995-10-10'], dtype='datetime64[ns]', freq=None)In the DatetimeIndex above, the data type datetime64[ns] indicates that the underlying data is stored as 64-bit integers, in units of nanoseconds (ns). This data structure allows pandas to compactly store large sequences of date/time values and efficiently perform vectorized operations using NumPy datetime64 arrays.

If we're dealing with a sequence of strings all in the same date/time format, we can explicitly specify it with the In addition to Timestamp and DatetimeIndex objects representing individual points in time, pandas also includes data structures representing durations (e.g., 125 seconds) and periods (e.g., the month of November 2018). For more about these data structures, there is a nice summary here. In this tutorial we will use DatetimeIndexes, the most common data structure for pandas time series. To work with time series data in pandas, we use a DatetimeIndex as the index for our DataFrame (or Series). Let's see how to do this with our OPSD data set. First, we use the The DataFrame has 4383 rows, covering the period from January 1, 2006 through December 31, 2017. To see what the data looks like, let's use the Next, let's check out the data types of each column. Now that the Alternatively, we can consolidate the above steps into a single line, using the Now that our DataFrame's index is a DatetimeIndex, we can use all of pandas' powerful time-based indexing to wrangle and analyze our data, as we shall see in the following sections. Another useful aspect of the DatetimeIndex is that the individual date/time components are all available as attributes such as One of the most powerful and convenient features of pandas time series is time-based indexing — using dates and times to intuitively organize and access our data. With time-based indexing, we can use date/time formatted strings to select data in our DataFrame with the For example, we can select data for a single day using a string such as We can also select a slice of days, such as Another very handy feature of pandas time series is partial-string indexing, where we can select all date/times which partially match a given string. For example, we can select the entire year 2006 with With pandas and matplotlib, we can easily visualize our time series data. In this section, we'll cover a few examples and some useful customizations for our time series plots. First, let's import matplotlib. We'll use seaborn styling for our plots, and let's adjust the default figure size to an appropriate shape for time series plots. Let's create a line plot of the full time series of Germany's daily electricity consumption, using the DataFrame's We can see that the We can already see some interesting patterns emerge: All three time series clearly exhibit periodicity—often referred to as seasonality in time series analysis—in which a pattern repeats again and again at regular time intervals. The Seasonality can also occur on other time scales. The plot above suggests there may be some weekly seasonality in Germany's electricity consumption, corresponding with weekdays and weekends. Let's plot the time series in a single year to investigate further. Now we can clearly see the weekly oscillations. Another interesting feature that becomes apparent at this level of granularity is the drastic decrease in electricity consumption in early January and late December, during the holidays. Let's zoom in further and look at just January and February. As we suspected, consumption is highest on weekdays and lowest on weekends. To better visualize the weekly seasonality in electricity consumption in the plot above, it would be nice to have vertical gridlines on a weekly time scale (instead of on the first day of each month). We can customize our plot with matplotlib.dates, so let's import that module. Because date/time ticks are handled a bit differently in matplotlib.dates compared with the DataFrame's Now we have vertical gridlines and nicely formatted tick labels on each Monday, so we can easily tell which days are weekdays and weekends. There are many other ways to visualize time series, depending on what patterns you're trying to explore — scatter plots, heatmaps, histograms, and so on. We'll see other visualization examples in the following sections, including visualizations of time series data that has been transformed in some way, such as aggregated or smoothed data. Next, let's further explore the seasonality of our data with box plots, using seaborn's These box plots confirm the yearly seasonality that we saw in earlier plots and provide some additional insights: Next, let's group the electricity consumption time series by day of the week, to explore weekly seasonality. As expected, electricity consumption is significantly higher on weekdays than on weekends. The low outliers on weekdays are presumably during holidays. This section has provided a brief introduction to time series seasonality. As we will see later, applying a rolling window to the data can also help to visualize seasonality on different time scales. Other techniques for analyzing seasonality include autocorrelation plots, which plot the correlation coefficients of the time series with itself at different time lags. Time series with strong seasonality can often be well represented with models that decompose the signal into seasonality and a long-term trend, and these models can be used to forecast future values of the time series. A simple example of such a model is classical seasonal decomposition, as demonstrated in this tutorial. A more sophisticated example is as Facebook's Prophet model, which uses curve fitting to decompose the time series, taking into account seasonality on multiple time scales, holiday effects, abrupt changepoints, and long-term trends, as demonstrated in this tutorial. When the data points of a time series are uniformly spaced in time (e.g., hourly, daily, monthly, etc.), the time series can be associated with a frequency in pandas. For example, let's use the The resulting DatetimeIndex has an attribute As another example, let's create a date range at hourly frequency, specifying the start date and number of periods, instead of the start date and end date. Now let's take another look at the DatetimeIndex of our We can see that it has no frequency ( If we know that our data should be at a specific frequency, we can use the DataFrame's To see how this works, let's create a new DataFrame which contains only the Now we use the In the If you're doing any time series analysis which requires uniformly spaced data without any missings, you'll want to use It is often useful to resample our time series data to a lower or higher frequency. Resampling to a lower frequency (downsampling) usually involves an aggregation operation — for example, computing monthly sales totals from daily data. The daily OPSD data we're working with in this tutorial was downsampled from the original hourly time series. Resampling to a higher frequency (upsampling) is less common and often involves interpolation or other data filling method — for example, interpolating hourly weather data to 10 minute intervals for input to a scientific model. We will focus here on downsampling, exploring how it can help us analyze our OPSD data on various time scales. We use the DataFrame's For example, let's resample the data to a weekly mean time series. The first row above, labelled By construction, our weekly time series has 1/7 as many data points as the daily time series. We can confirm this by comparing the number of rows of the two DataFrames. Let's plot the daily and weekly We can see that the weekly mean time series is smoother than the daily time series because higher frequency variability has been averaged out in the resampling. Now let's resample the data to monthly frequency, aggregating with sum totals instead of the mean. Unlike aggregating with You might notice that the monthly resampled data is labelled with the end of each month (the right bin edge), whereas the weekly resampled data is labelled with the left bin edge. By default, resampled data is labelled with the right bin edge for monthly, quarterly, and annual frequencies, and with the left bin edge for all other frequencies. This behavior and various other options can be adjusted using the parameters listed in the Now let's explore the monthly time series by plotting the electricity consumption as a line plot, and the wind and solar power production together as a stacked area plot. At this monthly time scale, we can clearly see the yearly seasonality in each time series, and it is also evident that electricity consumption has been fairly stable over time, while wind power production has been growing steadily, with wind + solar power comprising an increasing share of the electricity consumed. Let's explore this further by resampling to annual frequency and computing the ratio of Finally, let's plot the wind + solar share of annual electricity consumption as a bar chart. We can see that wind + solar production as a share of annual electricity consumption has been increasing from about 15% in 2012 to about 27% in 2017. Rolling window operations are another important transformation for time series data. Similar to downsampling, rolling windows split the data into time windows and and the data in each window is aggregated with a function such as By default, all data points within a window are equally weighted in the aggregation, but this can be changed by specifying window types such as Gaussian, triangular, and others. We'll stick with the standard equally weighted window here. Let's use the We can see that the first non-missing rolling mean value is on To visualize the differences between rolling mean and resampling, let's update our earlier plot of January-June 2017 solar power production to include the 7-day rolling mean along with the weekly mean resampled time series and the original daily data. We can see that data points in the rolling mean time series have the same spacing as the daily data, but the curve is smoother because higher frequency variability has been averaged out. In the rolling mean time series, the peaks and troughs tend to align closely with the peaks and troughs of the daily time series. In contrast, the peaks and troughs in the weekly resampled time series are less closely aligned with the daily time series, since the resampled time series is at a coarser granularity. Time series data often exhibit some slow, gradual variability in addition to higher frequency variability such as seasonality and noise. An easy way to visualize these trends is with rolling means at different time scales. A rolling mean tends to smooth a time series by averaging out variations at frequencies much higher than the window size and averaging out any seasonality on a time scale equal to the window size. This allows lower-frequency variations in the data to be explored. Since our electricity consumption time series has weekly and yearly seasonality, let's look at rolling means on those two time scales. We've already computed 7-day rolling means, so now let's compute the 365-day rolling mean of our OPSD data. Let's plot the 7-day and 365-day rolling mean electricity consumption, along with the daily time series. We can see that the 7-day rolling mean has smoothed out all the weekly seasonality, while preserving the yearly seasonality. The 7-day rolling mean reveals that while electricity consumption is typically higher in winter and lower in summer, there is a dramatic decrease for a few weeks every winter at the end of December and beginning of January, during the holidays. Looking at the 365-day rolling mean time series, we can see that the long-term trend in electricity consumption is pretty flat, with a couple of periods of anomalously low consumption around 2009 and 2012-2013. Now let's look at trends in wind and solar production. We can see a small increasing trend in solar power production and a large increasing trend in wind power production, as Germany continues to expand its capacity in those sectors. We've learned how to wrangle, analyze, and visualize our time series data in pandas using techniques such as time-based indexing, resampling, and rolling windows. Applying these techniques to our OPSD data set, we've gained insights on seasonality, trends, and other interesting features of electricity consumption and production in Germany. Other potentially useful topics we haven't covered include time zone handling and time shifts. If you'd like to learn more about working with time series data in pandas, you can check out this section of the Python Data Science Handbook, this blog post, and of course the official documentation. If you're interested in forecasting and machine learning with time series data, we'll be covering those topics in a future blog post, so stay tuned! If you’d like to learn more about this topic, check out Dataquest's interactive Pandas and NumPy Fundamentals course, and our Data Analyst in Python, and Data Scientist in Python paths that will help you become job-ready in around 6 months.format parameter. For very large data sets, this can greatly speed up the performance of to_datetime() compared to the default behavior, where the format is inferred separately for each individual string. Any of the format codes from the strftime() and strptime() functions in Python's built-in datetime module can be used. The example below uses the format codes pd.to_datetime(['2/25/10', '8/6/17', '12/15/12'], format=

DatetimeIndex(['2010-02-25', '2017-08-06', '2012-12-15'], dtype='datetime64[ns]', freq=None)

Creating a time series DataFrame

read_csv() function to read the data into a DataFrame, and then display its shape.

opsd_daily = pd.read_csv('opsd_germany_daily.csv')

opsd_daily.shape

(4383, 5)

head() and tail() methods to display the first three and last three rows.opsd_daily.head(3)

Date

Consumption

Wind

Solar

Wind+Solar

0

2006-01-01

1069.184

NaN

NaN

NaN

1

2006-01-02

1380.521

NaN

NaN

NaN

2

2006-01-03

1442.533

NaN

NaN

NaN

opsd_daily.tail(3)

Date

Consumption

Wind

Solar

Wind+Solar

4380

2017-12-29

1295.08753

584.277

29.854

614.131

4381

2017-12-30

1215.44897

721.247

7.467

728.714

4382

2017-12-31

1107.11488

721.176

19.980

741.156

opsd_daily.dtypes

Date datetime64[ns]

Consumption float64

Wind float64

Solar float64

Wind+Solar float64

dtype: object

Date column is the correct data type, let's set it as the DataFrame's index.

opsd_daily = opsd_daily.set_index('Date')

opsd_daily.head(3)

Consumption

Wind

Solar

Wind+Solar

Date

2006-01-01

1069.184

NaN

NaN

NaN

2006-01-02

1380.521

NaN

NaN

NaN

2006-01-03

1442.533

NaN

NaN

NaN

opsd_daily.index

DatetimeIndex(['2006-01-01', '2006-01-02', '2006-01-03', '2006-01-04',

'2006-01-05', '2006-01-06', '2006-01-07', '2006-01-08',

'2006-01-09', '2006-01-10',

...

'2017-12-22', '2017-12-23', '2017-12-24', '2017-12-25',

'2017-12-26', '2017-12-27', '2017-12-28', '2017-12-29',

'2017-12-30', '2017-12-31'],

dtype='datetime64[ns]', name='Date', length=4383, freq=None)

index_col and parse_dates parameters of the read_csv() function. This is often a useful shortcut.

opsd_daily = pd.read_csv('opsd_germany_daily.csv', index_col=0, parse_dates=True)

year, month, day, and so on. Let's add a few more columns to opsd_daily, containing the year, month, and weekday name.

# Add columns with year, month, and weekday name

opsd_daily['Year'] = opsd_daily.index.year

opsd_daily['Month'] = opsd_daily.index.month

opsd_daily['Weekday Name'] = opsd_daily.index.weekday_name

# Display a random sampling of 5 rows

opsd_daily.sample(5, random_state=0)

Consumption

Wind

Solar

Wind+Solar

Year

Month

Weekday Name

Date

2008-08-23

1152.011

NaN

NaN

NaN

2008

8

Saturday

2013-08-08

1291.984

79.666

93.371

173.037

2013

8

Thursday

2009-08-27

1281.057

NaN

NaN

NaN

2009

8

Thursday

2015-10-02

1391.050

81.229

160.641

241.870

2015

10

Friday

2009-06-02

1201.522

NaN

NaN

NaN

2009

6

Tuesday

Time-based indexing

loc accessor. The indexing works similar to standard label-based indexing with loc, but with a few additional features.'2017-08-10'.

opsd_daily.loc['2017-08-10']

Consumption 1351.49

Wind 100.274

Solar 71.16

Wind+Solar 171.434

Year 2017

Month 8

Weekday Name Thursday

Name: 2017-08-10 00:00:00, dtype: object

'2014-01-20':'2014-01-22'. As with regular label-based indexing with loc, the slice is inclusive of both endpoints.

opsd_daily.loc['2014-01-20':'2014-01-22']

Consumption

Wind

Solar

Wind+Solar

Year

Month

Weekday Name

Date

2014-01-20

1590.687

78.647

6.371

85.018

2014

1

Monday

2014-01-21

1624.806

15.643

5.835

21.478

2014

1

Tuesday

2014-01-22

1625.155

60.259

11.992

72.251

2014

1

Wednesday

opsd_daily.loc['2006'], or the entire month of February 2012 with opsd_daily.loc['2012-02'].

opsd_daily.loc['2012-02']

Consumption

Wind

Solar

Wind+Solar

Year

Month

Weekday Name

Date

2012-02-01

1511.866

199.607

43.502

243.109

2012

2

Wednesday

2012-02-02

1563.407

73.469

44.675

118.144

2012

2

Thursday

2012-02-03

1563.631

36.352

46.510

82.862

2012

2

Friday

2012-02-04

1372.614

20.551

45.225

65.776

2012

2

Saturday

2012-02-05

1279.432

55.522

54.572

110.094

2012

2

Sunday

2012-02-06

1574.766

34.896

55.389

90.285

2012

2

Monday

2012-02-07

1615.078

100.312

19.867

120.179

2012

2

Tuesday

2012-02-08

1613.774

93.763

36.930

130.693

2012

2

Wednesday

2012-02-09

1591.532

132.219

19.042

151.261

2012

2

Thursday

2012-02-10

1581.287

52.122

34.873

86.995

2012

2

Friday

2012-02-11

1377.404

32.375

44.629

77.004

2012

2

Saturday

2012-02-12

1264.254

62.659

45.176

107.835

2012

2

Sunday

2012-02-13

1561.987

25.984

11.287

37.271

2012

2

Monday

2012-02-14

1550.366

146.495

9.610

156.105

2012

2

Tuesday

2012-02-15

1476.037

413.367

18.877

432.244

2012

2

Wednesday

2012-02-16

1504.119

130.247

38.176

168.423

2012

2

Thursday

2012-02-17

1438.857

196.515

17.328

213.843

2012

2

Friday

2012-02-18

1236.069

237.889

26.248

264.137

2012

2

Saturday

2012-02-19

1107.431

272.655

30.382

303.037

2012

2

Sunday

2012-02-20

1401.873

160.315

53.794

214.109

2012

2

Monday

2012-02-21

1434.533

281.909

57.984

339.893

2012

2

Tuesday

2012-02-22

1453.507

287.635

74.904

362.539

2012

2

Wednesday

2012-02-23

1427.402

353.510

18.927

372.437

2012

2

Thursday

2012-02-24

1373.800

382.777

29.281

412.058

2012

2

Friday

2012-02-25

1133.184

302.102

42.667

344.769

2012

2

Saturday

2012-02-26

1086.743

95.234

37.214

132.448

2012

2

Sunday

2012-02-27

1436.095

86.956

43.099

130.055

2012

2

Monday

2012-02-28

1408.211

231.923

16.190

248.113

2012

2

Tuesday

2012-02-29

1434.062

77.024

30.360

107.384

2012

2

Wednesday

Visualizing time series data

import matplotlib.pyplot as plt

# Display figures inline in Jupyter notebook

import seaborn as sns

# Use seaborn style defaults and set the default figure size

sns.set(rc={'figure.figsize':(11, 4)})

plot() method.

opsd_daily['Consumption'].plot(linewidth=0.5);

plot() method has chosen pretty good tick locations (every two years) and labels (the years) for the x-axis, which is helpful. However, with so many data points, the line plot is crowded and hard to read. Let's plot the data as dots instead, and also look at the Solar and Wind time series.

cols_plot = ['Consumption', 'Solar', 'Wind']

axes = opsd_daily[cols_plot].plot(marker='.', alpha=0.5, linestyle='None', figsize=(11, 9), subplots=True)

for ax in axes:

ax.set_ylabel('Daily Totals (GWh)')

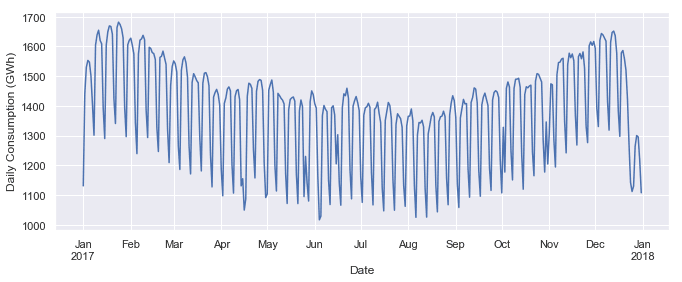

Consumption, Solar, and Wind time series oscillate between high and low values on a yearly time scale, corresponding with the seasonal changes in weather over the year. However, seasonality in general does not have to correspond with the meteorological seasons. For example, retail sales data often exhibits yearly seasonality with increased sales in November and December, leading up to the holidays.

ax = opsd_daily.loc['2017', 'Consumption'].plot()

ax.set_ylabel('Daily Consumption (GWh)');

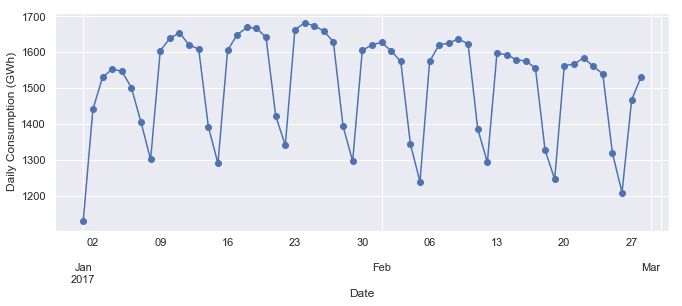

ax = opsd_daily.loc['2017-01':'2017-02', 'Consumption'].plot(marker='o', linestyle='-')

ax.set_ylabel('Daily Consumption (GWh)');

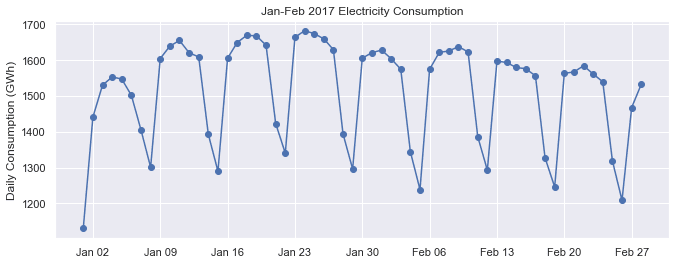

Customizing time series plots

import matplotlib.dates as mdates

plot() method, let's create the plot directly in matplotlib. Then we use mdates.WeekdayLocator() and mdates.MONDAY to set the x-axis ticks to the first Monday of each week. We also use mdates.DateFormatter() to improve the formatting of the tick labels, using the format codes we saw earlier.fig, ax = plt.subplots()

ax.plot(opsd_daily.loc['2017-01':'2017-02', 'Consumption'], marker='o', linestyle='-')

ax.set_ylabel('Daily Consumption (GWh)')

ax.set_title('Jan-Feb 2017 Electricity Consumption')

# Set x-axis major ticks to weekly interval, on Mondays

ax.xaxis.set_major_locator(mdates.WeekdayLocator(byweekday=mdates.MONDAY))

# Format x-tick labels as 3-letter month name and day number

ax.xaxis.set_major_formatter(mdates.DateFormatter(

Seasonality

boxplot() function to group the data by different time periods and display the distributions for each group. We'll first group the data by month, to visualize yearly seasonality.

fig, axes = plt.subplots(3, 1, figsize=(11, 10), sharex=True)

for name, ax in zip(['Consumption', 'Solar', 'Wind'], axes):

sns.boxplot(data=opsd_daily, x='Month', y=name, ax=ax)

ax.set_ylabel('GWh')

ax.set_title(name)

# Remove the automatic x-axis label from all but the bottom subplot

if ax != axes[-1]:

ax.set_xlabel('')

* Although electricity consumption is generally higher in winter and lower in summer, the median and lower two quartiles are lower in December and January compared to November and February, likely due to businesses being closed over the holidays. We saw this in the time series for the year 2017, and the box plot confirms that this is consistent pattern throughout the years.

* While solar and wind power production both exhibit a yearly seasonality, the wind power distributions have many more outliers, reflecting the effects of occasional extreme wind speeds associated with storms and other transient weather conditions.

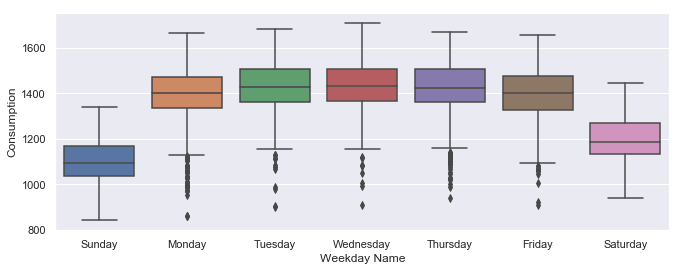

sns.boxplot(data=opsd_daily, x='Weekday Name', y='Consumption');

Frequencies

date_range() function to create a sequence of uniformly spaced dates from 1998-03-10 through 1998-03-15 at daily frequency.

pd.date_range('1998-03-10', '1998-03-15', freq='D')

DatetimeIndex(['1998-03-10', '1998-03-11', '1998-03-12', '1998-03-13',

'1998-03-14', '1998-03-15'],

dtype='datetime64[ns]', freq='D')

freq with a value of 'D', indicating daily frequency. Available frequencies in pandas include hourly ('H'), calendar daily ('D'), business daily ('B'), weekly ('W'), monthly ('M'), quarterly ('Q'), annual ('A'), and many others. Frequencies can also be specified as multiples of any of the base frequencies, for example '5D' for every five days.

pd.date_range('2004-09-20', periods=8, freq='H')

DatetimeIndex(['2004-09-20 00:00:00', '2004-09-20 01:00:00',

'2004-09-20 02:00:00', '2004-09-20 03:00:00',

'2004-09-20 04:00:00', '2004-09-20 05:00:00',

'2004-09-20 06:00:00', '2004-09-20 07:00:00'],

dtype='datetime64[ns]', freq='H')

opsd_daily time series.

opsd_daily.index

DatetimeIndex(['2006-01-01', '2006-01-02', '2006-01-03', '2006-01-04',

'2006-01-05', '2006-01-06', '2006-01-07', '2006-01-08',

'2006-01-09', '2006-01-10',

...

'2017-12-22', '2017-12-23', '2017-12-24', '2017-12-25',

'2017-12-26', '2017-12-27', '2017-12-28', '2017-12-29',

'2017-12-30', '2017-12-31'],

dtype='datetime64[ns]', name='Date', length=4383, freq=None)

freq=None). This makes sense, since the index was created from a sequence of dates in our CSV file, without explicitly specifying any frequency for the time series.asfreq() method to assign a frequency. If any date/times are missing in the data, new rows will be added for those date/times, which are either empty (NaN), or filled according to a specified data filling method such as forward filling or interpolation.Consumption data for Feb 3, 6, and 8, 2013.

# To select an arbitrary sequence of date/time values from a pandas time series,

# we need to use a DatetimeIndex, rather than simply a list of date/time strings

times_sample = pd.to_datetime(['2013-02-03', '2013-02-06', '2013-02-08'])

# Select the specified dates and just the Consumption column

consum_sample = opsd_daily.loc[times_sample, ['Consumption']].copy()

consum_sample

Consumption

2013-02-03

1109.639

2013-02-06

1451.449

2013-02-08

1433.098

asfreq() method to convert the DataFrame to daily frequency, with a column for unfilled data, and a column for forward filled data.

# Convert the data to daily frequency, without filling any missings

consum_freq = consum_sample.asfreq('D')

# Create a column with missings forward filled

consum_freq['Consumption - Forward Fill'] = consum_sample.asfreq('D', method='ffill')

consum_freq

Consumption

Consumption - Forward Fill

2013-02-03

1109.639

1109.639

2013-02-04

NaN

1109.639

2013-02-05

NaN

1109.639

2013-02-06

1451.449

1451.449

2013-02-07

NaN

1451.449

2013-02-08

1433.098

1433.098

Consumption column, we have the original data, with a value of NaN for any date that was missing in our consum_sample DataFrame. In the Consumption - Forward Fill column, the missings have been forward filled, meaning that the last value repeats through the missing rows until the next non-missing value occurs.asfreq() to convert your time series to the specified frequency and fill any missings with an appropriate method.Resampling

resample() method, which splits the DatetimeIndex into time bins and groups the data by time bin. The resample() method returns a Resampler object, similar to a pandas GroupBy object. We can then apply an aggregation method such as mean(), median(), sum(), etc., to the data group for each time bin.

# Specify the data columns we want to include (i.e. exclude Year, Month, Weekday Name)

data_columns = ['Consumption', 'Wind', 'Solar', 'Wind+Solar']

# Resample to weekly frequency, aggregating with mean

opsd_weekly_mean = opsd_daily[data_columns].resample('W').mean()

opsd_weekly_mean.head(3)

Consumption

Wind

Solar

Wind+Solar

Date

2006-01-01

1069.184000

NaN

NaN

NaN

2006-01-08

1381.300143

NaN

NaN

NaN

2006-01-15

1486.730286

NaN

NaN

NaN

2006-01-01, contains the mean of all the data contained in the time bin 2006-01-01 through 2006-01-07. The second row, labelled 2006-01-08, contains the mean data for the 2006-01-08 through 2006-01-14 time bin, and so on. By default, each row of the downsampled time series is labelled with the right edge of the time bin.

print(opsd_daily.shape[0])

print(opsd_weekly_mean.shape[0])

4383

627

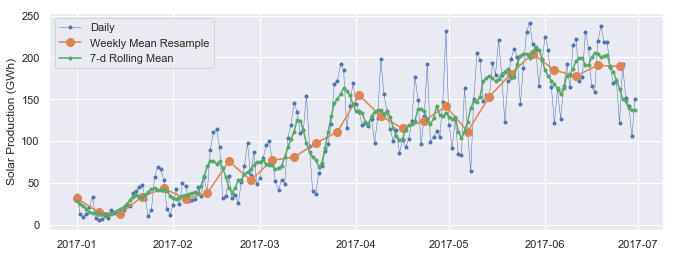

Solar time series together over a single six-month period to compare them.

# Start and end of the date range to extract

start, end = '2017-01', '2017-06'

# Plot daily and weekly resampled time series together

fig, ax = plt.subplots()

ax.plot(opsd_daily.loc[start:end, 'Solar'],

marker='.', linestyle='-', linewidth=0.5, label='Daily')

ax.plot(opsd_weekly_mean.loc[start:end, 'Solar'],

marker='o', markersize=8, linestyle='-', label='Weekly Mean Resample')

ax.set_ylabel('Solar Production (GWh)')

ax.legend();

mean(), which sets the output to NaN for any period with all missing data, the default behavior of sum() will return output of 0 as the sum of missing data. We use the min_count parameter to change this behavior.

# Compute the monthly sums, setting the value to NaN for any month which has

# fewer than 28 days of data

opsd_monthly = opsd_daily[data_columns].resample('M').sum(min_count=28)

opsd_monthly.head(3)

Consumption

Wind

Solar

Wind+Solar

Date

2006-01-31

45304.704

NaN

NaN

NaN

2006-02-28

41078.993

NaN

NaN

NaN

2006-03-31

43978.124

NaN

NaN

NaN

resample() documentation.

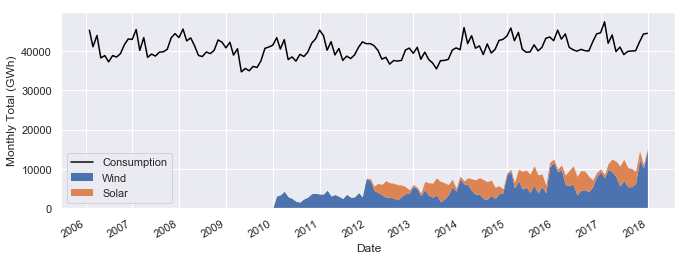

fig, ax = plt.subplots()

ax.plot(opsd_monthly['Consumption'], color='black', label='Consumption')

opsd_monthly[['Wind', 'Solar']].plot.area(ax=ax, linewidth=0)

ax.xaxis.set_major_locator(mdates.YearLocator())

ax.legend()

ax.set_ylabel('Monthly Total (GWh)');

Wind+Solar to Consumption for each year.

# Compute the annual sums, setting the value to NaN for any year which has

# fewer than 360 days of data

opsd_annual = opsd_daily[data_columns].resample('A').sum(min_count=360)

# The default index of the resampled DataFrame is the last day of each year,

# ('2006-12-31', '2007-12-31', etc.) so to make life easier, set the index

# to the year component

opsd_annual = opsd_annual.set_index(opsd_annual.index.year)

opsd_annual.index.name = 'Year'

# Compute the ratio of Wind+Solar to Consumption

opsd_annual['Wind+Solar/Consumption'] = opsd_annual['Wind+Solar'] / opsd_annual['Consumption']

opsd_annual.tail(3)

Consumption

Wind

Solar

Wind+Solar

Wind+Solar/Consumption

Year

2015

505264.56300

77468.994

34907.138

112376.132

0.222410

2016

505927.35400

77008.126

34562.824

111570.950

0.220528

2017

504736.36939

102667.365

35882.643

138550.008

0.274500

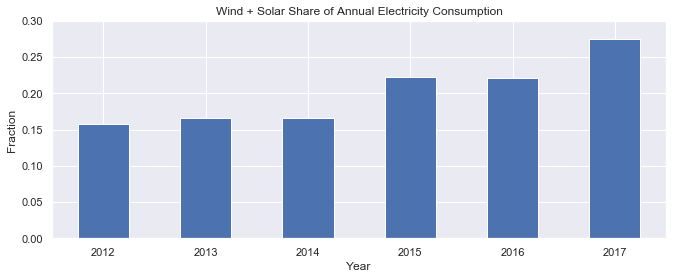

# Plot from 2012 onwards, because there is no solar production data in earlier years

ax = opsd_annual.loc[2012:, 'Wind+Solar/Consumption'].plot.bar(color='C0')

ax.set_ylabel('Fraction')

ax.set_ylim(0, 0.3)

ax.set_title('Wind + Solar Share of Annual Electricity Consumption')

plt.xticks(rotation=0);

Rolling windows

mean(), median(), sum(), etc. However, unlike downsampling, where the time bins do not overlap and the output is at a lower frequency than the input, rolling windows overlap and "roll" along at the same frequency as the data, so the transformed time series is at the same frequency as the original time series.rolling() method to compute the 7-day rolling mean of our daily data. We use the center=True argument to label each window at its midpoint, so the rolling windows are:

2006-01-01 to 2006-01-07 — labelled as 2006-01-042006-01-02 to 2006-01-08 — labelled as 2006-01-052006-01-03 to 2006-01-09 — labelled as 2006-01-06

# Compute the centered 7-day rolling mean

opsd_7d = opsd_daily[data_columns].rolling(7, center=True).mean()

opsd_7d.head(10)

Consumption

Wind

Solar

Wind+Solar

Date

2006-01-01

NaN

NaN

NaN

NaN

2006-01-02

NaN

NaN

NaN

NaN

2006-01-03

NaN

NaN

NaN

NaN

2006-01-04

1361.471429

NaN

NaN

NaN

2006-01-05

1381.300143

NaN

NaN

NaN

2006-01-06

1402.557571

NaN

NaN

NaN

2006-01-07

1421.754429

NaN

NaN

NaN

2006-01-08

1438.891429

NaN

NaN

NaN

2006-01-09

1449.769857

NaN

NaN

NaN

2006-01-10

1469.994857

NaN

NaN

NaN

2006-01-04, because this is the midpoint of the first rolling window.

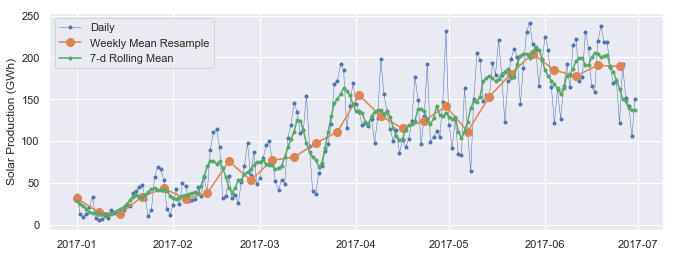

# Start and end of the date range to extract

start, end = '2017-01', '2017-06'

# Plot daily, weekly resampled, and 7-day rolling mean time series together

fig, ax = plt.subplots()

ax.plot(opsd_daily.loc[start:end, 'Solar'],

marker='.', linestyle='-', linewidth=0.5, label='Daily')

ax.plot(opsd_weekly_mean.loc[start:end, 'Solar'],

marker='o', markersize=8, linestyle='-', label='Weekly Mean Resample')

ax.plot(opsd_7d.loc[start:end, 'Solar'],

marker='.', linestyle='-', label='7-d Rolling Mean')

ax.set_ylabel('Solar Production (GWh)')

ax.legend();

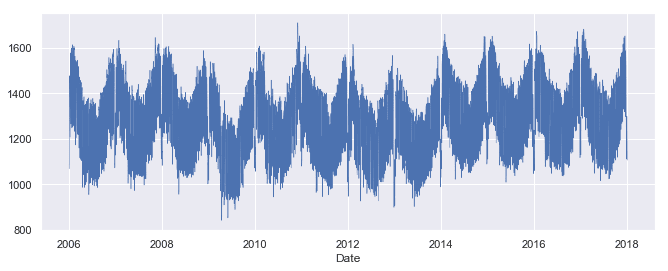

Trends

# The min_periods=360 argument accounts for a few isolated missing days in the

# wind and solar production time series

opsd_365d = opsd_daily[data_columns].rolling(window=365, center=True, min_periods=360).mean()

# Plot daily, 7-day rolling mean, and 365-day rolling mean time series

fig, ax = plt.subplots()

ax.plot(opsd_daily['Consumption'], marker='.', markersize=2, color='0.6',

linestyle='None', label='Daily')

ax.plot(opsd_7d['Consumption'], linewidth=2, label='7-d Rolling Mean')

ax.plot(opsd_365d['Consumption'], color='0.2', linewidth=3,

label='Trend (365-d Rolling Mean)')

# Set x-ticks to yearly interval and add legend and labels

ax.xaxis.set_major_locator(mdates.YearLocator())

ax.legend()

ax.set_xlabel('Year')

ax.set_ylabel('Consumption (GWh)')

ax.set_title('Trends in Electricity Consumption');

# Plot 365-day rolling mean time series of wind and solar power

fig, ax = plt.subplots()

for nm in ['Wind', 'Solar', 'Wind+Solar']:

ax.plot(opsd_365d[nm], label=nm)

# Set x-ticks to yearly interval, adjust y-axis limits, add legend and labels

ax.xaxis.set_major_locator(mdates.YearLocator())

ax.set_ylim(0, 400)

ax.legend()

ax.set_ylabel('Production (GWh)')

ax.set_title('Trends in Electricity Production (365-d Rolling Means)');

Summary and further reading